Shenghe Resources Increases its Bid for Peak Rare Earths: What It Means for Investors

In an exciting development for investors and industry-watchers alike, Chinese suitor Shenghe Resources has significantly amended its takeover bid for Peak Rare Earths (ASX:PEK). The revised offer now proposes a cash share price of 44.3 cents, up from the initial bid of approximately 36 cents – representing a 32% premium over Peak's closing price just prior to the announcement.

Strategic Implications for the Rare Earths Market

This updated offer values Peak's stake at roughly $195 million. Shenghe Resources, already an existing shareholder of Peak and one of the largest importers of rare earth concentrates into China, sees potential in Peak's Ngualla project, where Peak holds an impressive 84% interest. By enhancing its bid, Shenghe not only strengthens its position in the critical minerals sector but also signals its long-term strategy to consolidate resource assets in a market where demand is surging.

Peak's Positive Response and Future Directions

In light of Shenghe’s sweetened bid, Peak’s Independent Board Committee has endorsed the proposal, encouraging shareholders to vote in favor of the plan. This decision underscores a broader confidence in Peak’s market position amidst rising global demand for rare earth elements, essential for emerging technologies and sustainable energy solutions.

Insights from Recent Developments in Antimony Mining

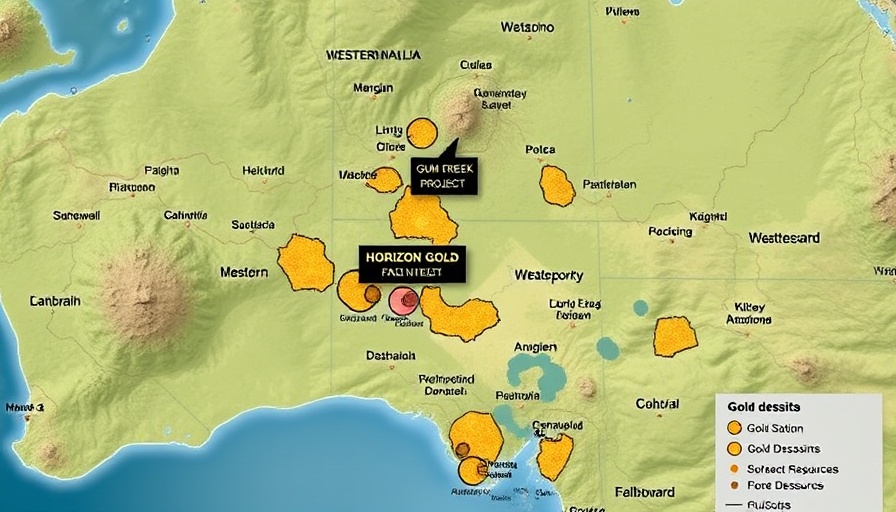

Simultaneously, another mining company, Marquee Resources (ASX:MQR), has confirmed consistent high-grade antimony at its Mt Clement project in Western Australia. This noteworthy development links back to the increasing significance of critical minerals, like rare earths and antimony, in light of the global transition towards sustainable construction practices and green technologies. Such advancements highlight the importance of diversified mineral portfolios for investors as they seek to navigate a rapidly evolving resource landscape.

What Does This Mean for Stakeholders?

For contractors and builders committed to sustainable practices, these developments present opportunities for growth and innovation. Integrating rare earths and antimony into construction materials could aid in creating more sustainable building solutions. Understanding shifts in this sector allows stakeholders to remain proactive about sourcing critical materials that will power future technologies.

Conclusion: Staying Ahead in a Fast-Paced Industry

As companies like Shenghe and Marquee make strategic moves in the resources sector, it’s crucial for industry professionals to keep an eye on these trends. Following these developments can provide valuable insights into potential avenues for investment and innovation in sustainable construction practices.

Add Row

Add Row  Add

Add

Write A Comment